Christmas comes but once each year, unfortunately, so close to New Years Day that there isn’t enough time to digest the presents before having to cope with the onrushing new year.

Bad Santa: the personification of twenty-first century America and its lost war on crazy, the ranting, heavily armed madman, precursor and catalyst to bloodletting on an industrial scale “John Brown” by John Steuart Curry.

Santa — the presumably sane one — made his rounds as usual, visiting Wall Street and putting under the tree the gift that keeps on giving: hundreds of billions of dollars in low-cost loans!

Sorry, Dude! You’re not systemic enough. You can’t scale. The ordinary non-tycoon individual is too puny to bail out. Interestingly enough, these funds are sourced from the same banks that are being gifted, with the Treasury and the New York Fed acting as middlemen /slash/ money laundries. The Treasury borrows (trillions) from finance, offering IOUs — bonds, bills or notes — as collateral. These bonds, bills and notes (and other securities) are now handed back to the central bank in exchange for new loans to the finance firms. It’s the same as Santa wheedling gifts from the elves in order to give these same gifts right back to the elves later! Ordinary citizens are left to rot outside this charmed circle; they have no funds to offer anyone or collateral other than their time, which has already been pledged without their knowledge or consent, and that of their children and grandchildren and many more generations to come.

Something that seems important is going on in repo. Usually commercial banks lend back and forth to each other in overnight markets without the concern- or involvement of the central bank. The two-trillion-dollar repo market is where banks find funds to balance their books overnight or to stash collateral. For unknown reasons, beginning in September, the overnight repo (interest) rate gapped up to 10% instead of the ordinary market rate of around 2%. This rate jump was suggestive of deleveraging underway somewhere — perhaps in shadow banking sector — and a looming liquidity shortage. This triggered what has become an ongoing series of ’emergency’ facilities by the New York Fed = Santa racing to the rescue.

Rescue of what, exactly? There are theories and explanations and criticisms and more theories … there are also warnings about consequences, complicated conspiracy-like theories as well as theories that are so good they can only be shared with people who give them money first. Because nobody is willing or able to pinpoint a reason for the jump in overnight rates or how long the problem will last, the emergency loans are set to continue indefinitely.

It’s not far-fetched the 10% leap in repo was a kind of monetary false flag aimed at justifying easing in general. Easing of one kind or the other has been underway in the West since 2009; in Japan since the 1990s. Much of the Eurozone countries are still sporting negative interest rates on government bonds (easing), the Bank of Japan is still buying bonds (easing) even as the European Central Bank shut down its QE programs. It’s now the Fed’s turn to prime the pump and/or rescue the flagging economy.

Or is it? Besides bailing out the banks, or the dollar funding system generally, the Fed might be bailing out the insolvent fracking sector of the petroleum industry. Ominously, the Fed might be bailing out China, which is also insolvent. It might also be bailing out too big to fail billionaires, mindful that practically everything the Federal Reserve does- or might do provides elites with a helping hand. Along with fighting endless (losing) wars and cannibalizing our resource base, bailing out our betters has been our national project since the founding of this country. One would think after all this time they wouldn’t need any more support.

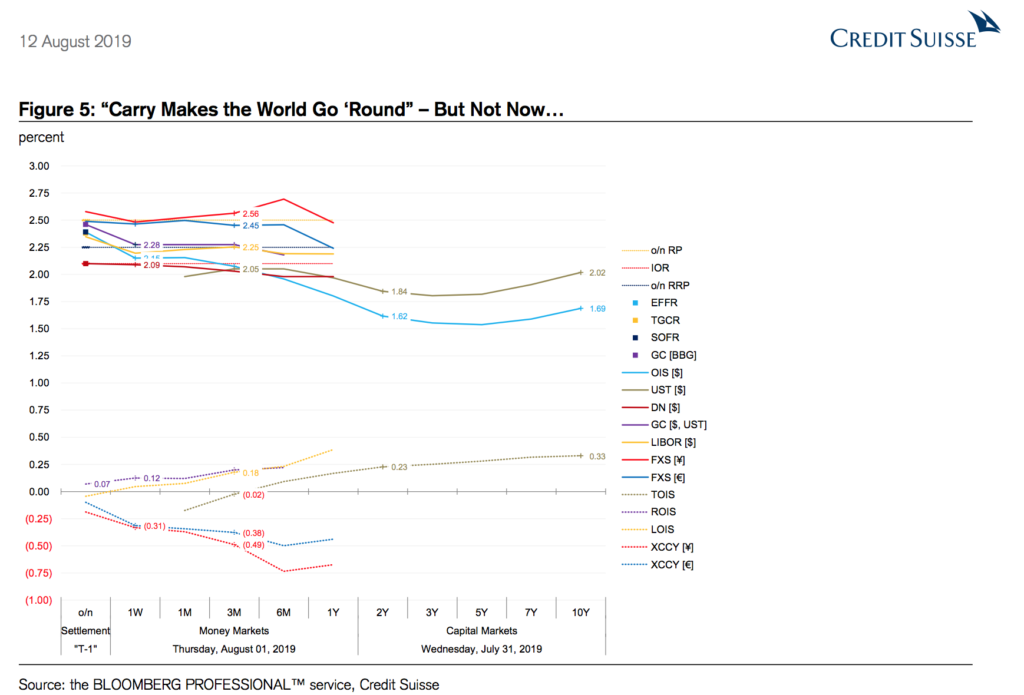

Figure 1: Yield curves and spreads for different lending instruments: chart by Zoltan Pozsar / Credit Suisse (Click for Big)

Repo guru Zoltan Pozsar’s theory: widening spreads and the inverted Treasury yield curve caused by recent Fed tightening has led to a dollar funding shortfall. Because the finding market has become reliant on low interest rates for a long period even the modest step up from the lower bound is causing hiccups.

This makes sense: Karl Denninger was making the same argument with less elaboration ten years ago: we’ve hooked ourselves on cheap credit for so long we can’t abide any other kind. Zoltan’s argument stumbles on the notion banks must acquire loanable funds, if not from each other then from the Fed, that they are tightly constrained by their own — and others’ — balance sheets. This suggests finance has caught itself; not so much in a liquidity trap but in an accountancy trap. The argument underestimates the commercial banks’ flexibility: they can- and do lend in excess of collateral, hypothecating then rehypothecating and re-re-hypoticating collateral, etc. in long and looping daisy chains of expanding leverage. Usually the problem with finance is ‘defective’ or inadequate bank money-capital and defective assets. This is not today’s problem within markets overflowing with US government securities, low interest rates and skyrocketing share prices.

Meanwhile, because banks can create credit with few limits, there is never a funding shortage … only a (creeping) creditworthiness shortage.

It is the central banks that are collateral-constrained. They cannot make unsecured loans and still be relied upon as lenders of last resort. “Interestingly enough, these funds are sourced from the same banks that are being gifted, with the Treasury and the New York Fed acting as middlemen /slash/ money laundries.” Zoltan explains the plumbing and how funds are shifted between different entities but he doesn’t answer the question of why some bank — or some bank’s client — might be seen as unworthy of credit.

Meanwhile, here’s a widening spread that causes severe headaches, that nobody wants to talk about. After all, Peak Oil is dead, right?

Figure 2: Trends heading in opposite directions: drilling costs and affordability. Graphic by TFC Charts, Click for Big.

The establishment has had decades of practice hiding fuel supply problems and lying about it. Instead of long lines at gas stations or odd-even days, fuel flows freely while allocation issues that once annoyed motorists now emerge like vengeful ghosts in odd corners of the credit markets or foreign exchange. (Guardian):

“You can make an argument that the Federal Reserve is entirely responsible for the fracking boom,” one private-equity titan told me. That view is echoed by Amir Azar, a fellow at Columbia University’s Center on Global Energy Policy. “The real catalyst of the shale revolution was the 2008 financial crisis and the era of unprecedentedly low interest rates it ushered in,” he wrote in a recent report. Another investor put it this way: “If companies were forced to live within the cash flow they produce, US oil would not be a factor in the rest of the world, and would have grown at a quarter to half the rate that it has.”

Central banks are too smart to bail out the customers who are steadily impoverished by their own consumption, not smart enough to stay away from the drillers who make consumption possible. Because customers can’t access credit in sufficient amounts to bail anyone out including themselves, drillers need loans. The frackers cannot meet their obligations out of cash flow, they are $100 billion in the red and counting. Yet, drill they must or no driving! This means torquing finance every-which-a-way in an attempt to keep appearances up and the pump prices down. Welcome to the consumption trap. It’s non-negotiable.

Keep in mind all industrial businesses are credit dependent. There is very little difference between have to borrow a certain amount, like every industry does, and having to borrow that amount- plus a whole lot more like the frackers are doing. This industry isn’t a bagatelle, it can’t be walked away from and abandoned by the side of the road like carry traders. Frackers account for the entire increase in world petroleum extraction since 2010 as well as 100% of the increase of US natural gas. They’re too critical to fail! At the same time, lenders are looking at an open-ended commitment to an enterprise that never makes money. No wonder banks might appear queasy making loans to each other; nobody knows who is going to be on the hook for the next hundred billion. Under the circumstances, lenders are going to look for guarantees, if not from the government then from the Fed.

Since 2014, frackers in the US have pumped something on the order of five billion barrels, the equivalent of another North Sea or Prudhoe Bay. Ample supply and low prices during this period are a reason why US economic activity has been strong; not interest rates (and not who is president). Economic gains overall going forward would seem to be worth the cost of subsidizing drillers and holding prices down, if only for a little while.

China: A Ticking Time Bomb

China is the answer to the question; where is the next finance crisis going to emerge? The beginning of the crisis is likely underway.

China’s total corporate, household and government debt rose to 303% of GDP in the first quarter of 2019, from 297% in the same period a year earlier, the IIF said in a report this week which highlighted rising debt levels worldwide.“While authorities’ efforts to curb shadow bank lending (particularly to smaller companies) have prompted a cutback in non-financial corporate debt, net borrowing in other sectors has brought China’s total debt to over $40 trillion – some 15% of all global debt,” the report said.

If Chinese debt is the pile of firewood, bad Chinese debt is the match that sets it all on fire.

A new report from the Chinese central bank indicates that more than 13% of lenders in China are considered “high risk.”586 out of 4,379 Chinese lenders were found to be high risk by the People’s Bank of China’s (PBOC) latest “2019 China Financial Stability Report” (中国金融稳定报告(2019)), including over a third of rural lenders.

Post- Mao China has cobbled together a large, complex, USA-style energy-dependent industrial economy with a lot of built-in vulnerabilities. It’s a kind of camel: ‘a horse designed by committee’, a grab bag more-or-less shop-worn economic ideologies: scientific management, comparative advantage, mercantilism, supply-creating-demand, Keynesian, Marxist-Leninist-invisible hand, all of this as an unaccountable single-party police state. Like the rest of the industrialized world, China relies entirely on a constant increase in lending. At the same time, to rein in risk and/or as a result of it, much of China’s financial sector is deleveraging. This has led to capital (dollar) flight, credit stress and the ongoing failure of some Chinese banks:

China’s bank failures: a turning point for the systemThree recent bank failures show that China can take the short-term pain of financial clean-up and clear the way for more financial reform.

The defaults of three Chinese banks raised fears over a systemic collapse, prompting speculators to bet on a banking crisis

The government’s takeover of Baoshang Bank in May marked China’s most high-profile bank failure in two decades. The subsequent bailouts of Bank of Jinzhou and Heng Feng Bank by state-owned banks and the Central Huijin sovereign wealth fund in July and August fanned any talk of further bank failures.

— Chi Lo, (BNP Paribas)

Issues that weigh on Chinese face include an overpriced currency relative to the dollar, unbalanced demographics (too many men), an increasingly expensive labor force, and the playing out of gains from industrializing agriculture and urbanization; the low hanging fruit of catch-up growth. At the same time, costs of air- and water pollution are rising from over-development and the massive increase in car use. China’s latest major initiative, Belt and Road international development project stands in the shadow of China’s increasing military adventurism, yuan colonialism and the increased use of surveillance and the repression of millions, particularly in Hong Kong and Xinjiang.

The costs of over-consumption for China include saturated overseas’ markets and bubblish over-capacity, over dependence on the flows of foreign exchange for direct investment and as collateral for internal lending. China is seen as too aggressive and overbearing to be bailed out by the US central bank, however …

China is too big to fail. It needs dollars to prop up its currency as Chinese reserves make their way out of the country. If the Fed was to taking a preemptive step to provide dollar liquidity to Chinese banks, it would certainly do so quietly, by shoveling funds into an obscure corner of finance so that nobody would (hopefully) notice.

As we enter a new decade, can debt increase faster than income forever? Probably not but maybe through 2020.

Sure, the Fed doesn’t print money, but isn’t buying a Treasury at a premium to a market price “unsecured” in a sense. In bankruptcy law, collateral sometimes has a secured portion and an unsecured portion.

Happy New Year to all!

Very glad you are tackling this subject. I had a weird experience in early September when the bank where I have had my (very) small business account put a nearly one week hold on a check from another well known bank. Normally my business deposits clear overnight. I have had this account for well over 20 years. They had all sorts of strange excuses. The local branch would/could do nothing. I had to go to some sort of central office to get the funds released. I finally asked them “Are you guys running out of money?” It was right at the time of that first repo problem.

I am having trouble understanding this repo stuff. Will re-read your piece tomorrow after a good night’s sleep.

Meanwhile – another really good podcast “Madness, the Podcast.”

Banks really don’t have any money. Someone was making a story somewhere on the internet universe and was discussing robbing a bank and the other person was saying something along the lines of, “Why bother?”

No money in the bank is a good reason for them not go give you a loan. Of course they can, but they know you won’t know.

Here’s a place you can go to check the creditworthiness of your bank:

https://www.depositaccounts.com/banks/health.aspx

You mean this guy?

Yes, that guy. I haven’t heard anyone discuss Socrates in years. It reminds us that PPE (politics, philosophy and economics) is a real discipline that can’t be picked apart. You can’t just take out economics and discuss it alone. Well, you can but you will bring philosophy along in an implicit way through your unquestioned and, therefore, dubious assumptions.

My bank is very credit worthy so I guess it is the system itself that is not. That is sort of what you are trying to explain here, right?

They say that China bailed out the world economy after 2008. But the world cannot possibly bail out China – can it?

Good theories about which particular rat-holes all that Fed-printed money is being dumped down.

Here’s another theory from a commenter over at Wolf Richter’s web page:

This may or may not be the case as hedge funds taking on that much (Treasury) risk would hedge themselves (with derivatives) and in any case are relying on bank funding (regardless of which pipe the funds flow through). It’s hard to see hedge funds taking on enough risk to warrant a trillion-dollar bailout.

Why would banks fund hedge funds?

Because they cannot create credit on their own, they have to borrow from those that do.

Hi Steve.

Does it really matter at this stage of the game, which dark hole/s this worthless currency is going down?

What really matters Steve is that you’re back at the typewriter, on a consistent basis, @ Economic Undertow providing exceptional insights into this seemingly never-ending evisceration of Modern Industrial Society. The monetary system was never more than a highly sophisticated Ponzi Scheme to begin with, but its now devolved into an obscure abstraction. Nothing is real in the world of high finance. To suggest it’s financial voodoo would be to demean the art of Voodoo.

Soon, the system will collapse as a result of the climatic affects, hyper inflation/deflation, insurmountable debt, political seizure, critical mass of enlightened people, wars that go “A Bridge To Far,” panicked investors all heading for the exits at the same time, or something else or all of the above.

I personally don’t care anymore what brings it all down, but what I do care about is finding a place where I can go to get intelligent insight on the current state of affairs. There is not one other blog that meets the standard that I have for meaningful and brilliant content. There are of course other blogs/sites that provide good information, but generally in a parochial fashion with none of the required philosophical and historical insightfulness that you bring to the current predicament.

So Steve, and I am sure that I am not only speaking for myself, please keep at it. If for no other reason that to keep some us from succumbing to the insanity of our decadent times.