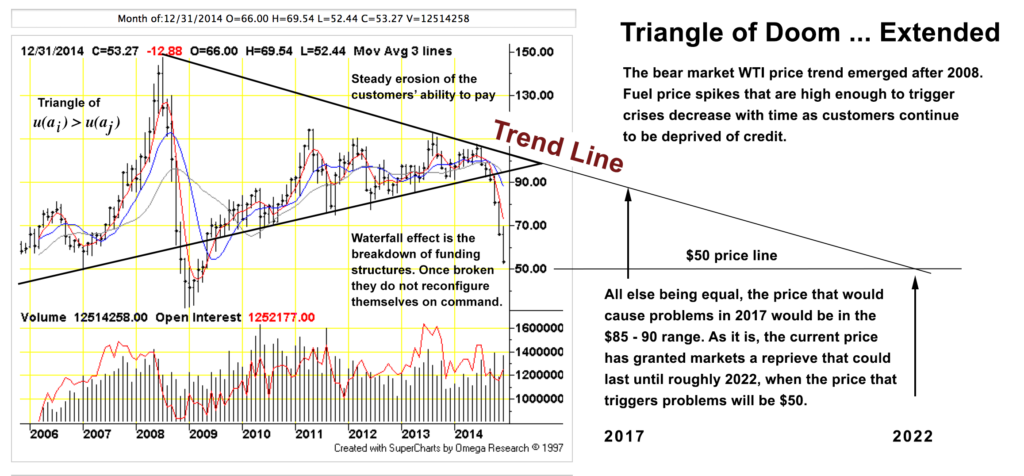

The Triangle of Doom, depicting the price level needed by the petroleum industry to remain solvent vs the price level that triggers an (energy) crisis. The price needed by industry increases steadily due to oil depletion and the added expense of retrieving, processing and transporting what remains. The triggering price decreases as end-users and their lenders are slowly ruined over time. Ironically, end-user insolvency is also due to depletion: purchasing power in general has a unitary relationship to the resources available for purchase. As resources disappear so does purchasing power; any- and all money claims against it become worthless. The customer- emptying process doesn’t happen overnight but it is relentless; the faster and more efficiently our precious economy ‘works’ the greater the rate of depletion and the sooner- with greater force the inevitable follow-on crises strike:

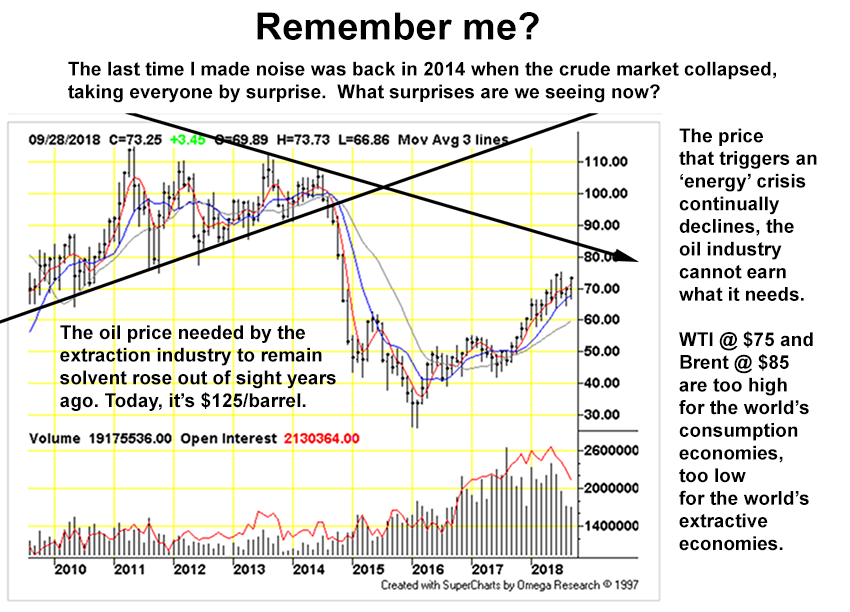

Figure 1: How high is too high? It’s lot lower than you think, (Chart by TFC Charts, click for big). Right now it looks like $75 (WTI) or $85 (Brent) are too high. This suggests a crisis is a lot closer than a lot of analysts might think. The trend line was identified a few years ago, it has carried foward pretty well:

Figure 2: Is the crisis here already? The implied ‘oil shock’ price for West Texas Intermediate the end of 2018 would appear to be in the area of $80/barrel. Car-dependent Americans will stump up but the petroleum market is international and customers overseas are brokety, broke, broke, broke.

– Regardless of what happens going forward, $50/barrel WTI will cause a crisis in 2022: that price will simply be too high. How high is too high, again?

– It’s possible there might not be any $50 oil available for sale in 2022! There might not be any oil at any price! We might be using up all the $50 oil right now. Financial- and political gyrations going forward are unpredictable, we simply cannot know. In Venezuela there are massive petroleum reserves that are relatively inexpensive to extract but the country is too poor to extract them. The country is not worthy of credit, it’s bankrupt. The chart says $50 dollars but not much else. The chart might be wrong: the entire world in 2022 might be as broke as Venezuela is now.

Economists and high-dollar analysts across the country rely on wishful thinking. They insist any US downturn is far in the future; the indicators are essentially full employment and modest inflation. Business profits and share prices appear to have nowhere to but up. Anything upsetting the current run of affairs is unthinkable, (Washington Post):

Federal Reserve Chair Jerome H. Powell said Tuesday that the U.S. economy appears to be in the midst of a “remarkably positive” period that is unprecedented in modern history.The Fed is predicting that unemployment will remain below 4 percent through 2020 and that inflation will stay low — around 2 percent — during that time. This has never happened in modern U.S. history. The last time unemployment was that low for several years, in the 1960s, it triggered high inflation, but the central bank and many outside forecasters don’t think that will occur this time.

“This historically rare pairing of steady, low inflation and very low unemployment is a testament to the fact we remain in extraordinary times,” Powell said in a speech at the annual meeting of the National Association for Business Economics (NABE) in Boston. “I was asked at last week’s news conference whether these forecasts are too good to be true — a reasonable question.”

If this sounds vaguely familiar, it should. It’s been seen and heard before. “The economy is fundamentally sound”: economists like Powell never plug resources or affordability into their Phillips Curves. They look down from their tower windows at the falsified, botoxed, ginned-up Frankenstein economy of today and assume tomorrow will be the same. To these guys, resources are ‘inputs’, capital is ‘money’. Economic agents are ‘rational self-maximisers’ with the emphasis on ‘misers’. Meanwhile, the ability of customers around the world to afford oil products diminishes every year as credit creation, central bank policy, finance bailouts, the diminished quality of employment and economic stratification all together deploy credit flows toward tycoons, away from everyone else.

Shifting the flows of credit the other way, toward those at the bottom of the economic ladder is not a panacea. The hapless multitudes would spend their credit as soon as it was in hand, funds would return to the banks as if they had never left. Debtors would end up worse off than before, more firmly indentured to their creditors than ever. Tricks with money and credit never create wealth, they do not create anything, only illusions that are unrelentingly harsh when they are revealed, which in this case they would most certainly be.

Meanwhile, more scarce capital would be consumed for nothing. Liberals who promote such schemes are well-meaning but charitable intent + policy frictions (and inevitable self-dealing) = ongoing insolvency and ruin. It is simply impossible for every one of 7.5 billions of us to live as middle-class suburban Americans, with cars, tract houses, luxury jobs and jet vacations. Instead, the escape from poverty has been ‘down-sized’ to ownership of a cellphone … the American middle class vanishes into the murk. In our Age of Less, someone must always remain standing behind the door.

The political crisis is the finance crisis … both are the energy crisis!

In the 1970s and 80s the shortage of energy manifested itself as long lines at gas stations, higher gasoline prices, informal rationing with 10 gallon per fill-up limits or ‘odd-even’ days at gas stations; the Federal government imposed the hated ‘Double-Nickel’; the 55 mph speed limits on expressways. The auto industry took a gigantic hit as drivers abandoned the guzzling behemoths that were Detroit’s bread and butter, replacing them with smaller, fuel efficient imports from Germany and Japan. A date that would mark the beginning of Detroit’s decline as a viable industrial center would be October, 17, 1973; the beginning of the Arab Oil Embargo.

Lifting oil tariffs, the deregulation of the finance industry and the opening of the North Sea and Prudhoe Bay oil fields put an end to shortages, so did ending the Iran-Iraq war. High US interest rates dampened post-Vietnam inflation which made it favorable for countries (oil exporters) to hold dollars. The end of shortages was temporary but enough time was given to the establishment for them to come up with management strategies to obviate energy problems going forward: entire economies would become speculative bubbles, petroleum would become another investible asset like mortgage bonds or office buildings. Fuel shortages were boiled down to the issue of price: if fuel prices rose, investors’ speculative wealth would rise faster. Everyone would get rich and spend the money on oversized SUVs subsidized indirectly w/ relatively cheap fuel. At the same time, high fuel prices would provide funding for domestic US oil exploration and extraction. It seemed to work because the oil markets were awash, money costs were decreasing due to a long-term bull market in bonds. The only flies in the speculative ointment were the collapses of the Japan bubble economy and the Soviet Union.

By the mid-1990s, oil was plentiful as OPEC, UK, Mexico and other drillers were dumping oil on the market competing for market share. This changed after 1999: demand caught up with supply and a bidding war for barrels commenced. There were no apparent shortages at the gas pump, prices rose alongside those of Americans’ number one asset: their real estate holdings. Ultimately, the finance bubble deflated as they all must; the ‘oil shock’ of ’07 to ’08 took the form of a finance implosion that gutted almost all of the world’s major lenders and destroyed the informal ‘shadow banking’ derivatives markets. Analysis pointed toward defective mortgage underwriting, failures by ratings agencies, opaque financial derivatives, self-dealing and fraud on the part of bankers and an excess of credit driven by Federal Reserve policies. Little mention was made of $147/barrel price in ’08, which hit customers world-wide. Mortgage borrowers were bankrupted, the foreclosure crisis was set to begin; gasoline was expensive @ $4/gallon but there were no gas lines or speed limits.

Energy crisis emerges now in currency markets, it also takes the form of a political crisis: state institutions around the world are subverted and representative nature of government becomes a sham. Policy making regimes are broken in the US, UK, Germany, Turkey, Venezuela, Brazil, Italy, Russia, Pakistan, India; across Africa; in Central Asia, Eastern Europe, Philippines and Central America. There is $3/gallon regular gas in the United States and some unhappy drivers but again, no gas lines. Is this success? Suppose someone out there must think so.

The economic establishment was complacent to the crisis building in finance in the early 2000s, it was taken unprepared by the Lehman bankruptcy and the near-failure of world’s banking giants – an energy crisis in drag. The establishment today is equally blind-sided by the political crisis that has emerged out of the ruins of the crash. Seemingly out of nowhere, democracies have morphed into autocracies. Neo-Nazis and extremist factions are ascendant along with increasing militarism and a rejection of the liberal, bourgeois, cosmopolitan Bretton-Woods consensus that was the product of the Great Depression and the Cold War.

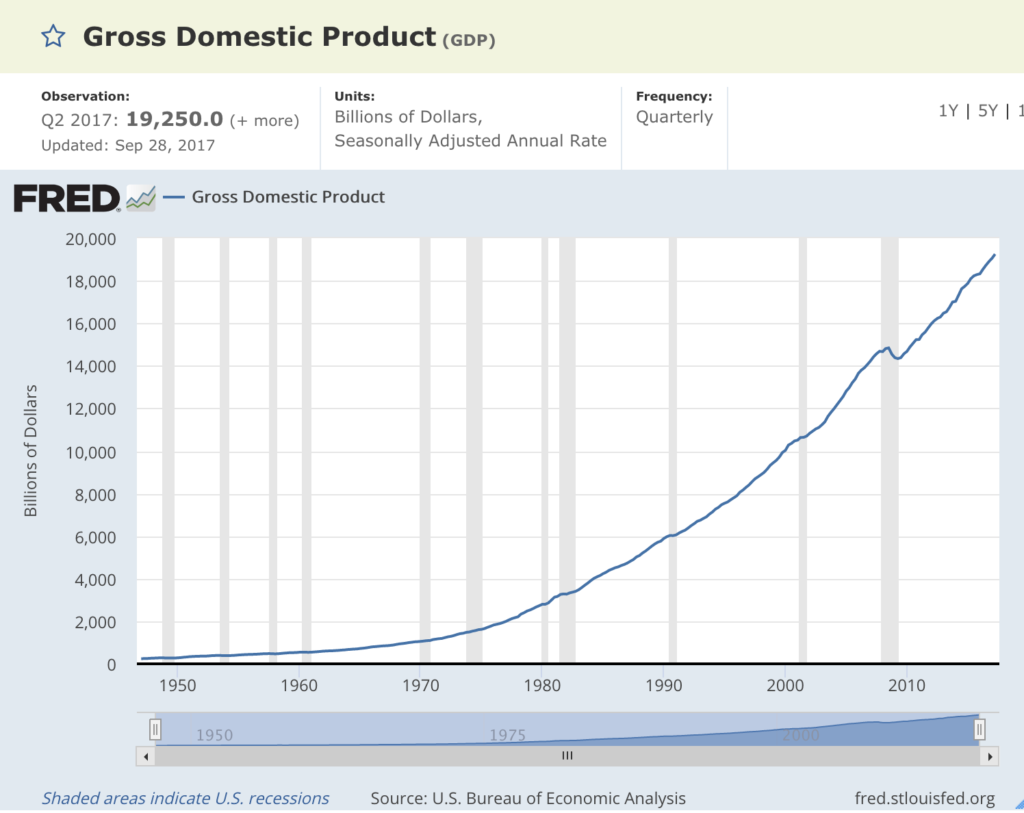

Figure 3: How many economists in 1950 predicted the geometric increase in US domestic product that was already underway … in 1950? They answer is ‘none’. How many economists can actually foresee anything?

Our political crisis can be seen now as the form the Great Finance Crisis has taken after the orchestrated bailouts, key man propping and continuous easy central bank meddling saved the banks and the criminal bosses. Yet … The impulse driving both yesterday’s crisis and today’s is identical: both are indirect forms of rationing. The roots of both crises are the same, they reach long into the past and the rise of the consumption economy after WWII. The rationing mechanisms are likewise similar: credit collapse inflicts financial violence; unlucky investors and over-exposed ‘suckers’ are ruined. In the period after the ’08 crisis, millions of US home-owners lost everything. Crashes have nothing to sell, they are the denouement that is at the end of the crime novel. Authoritarian states inflict political violence: they sell (the illusion of) advantage; of war, repression and genocide, of retributive violence against designated ‘others’. It can be seen both the Great Recession and the onrushing embrace of centralized state power are ‘Conservation by Other Means™’.

The crises are unpleasant … they occur because we are unwilling to face up to our resource ‘problems’ directly and take the steps to reduce our draw on them. The need is for us to grow up: to reduce our human numbers, to get rid of the hundreds of millions of useless, non-remunerative cars and the gigantically worthless enterprises – oil, construction, finance, real estate – that support them. These last represent the greatest draw on resources. We need to live closer to our jobs and alter the fundamental nature of work. We need to move away from business consolidation and quasi-nationalized industrial and financial cartels, to abandon the (false) efficiencies of scale. Along with our numbers we need to reduce those of our livestock. We need to rethink the nature and purpose of war, to re-imagine foreign affairs. We need to reduce the role of debt and money. Even as the need to do these things and much else besides becomes immediate, we clench our fists and have tantrums instead: if liberals cannot provide unlimited resource access then dictators will, any who oppose us will be destroyed. At the end of the day, entropy takes out the trash: our numbers are reduced due to violence, disease and starvation, both work and money vanish; there is less consumption by force majeure. Our toys turn to rust because the rate of depletion in oil fields does not allow us the time needed to deploy replacements … or to make changes in how our current toys are used.

Meanwhile, autocracy is a fashion, the Orwellian totalitarian police states were one-time innovations that took place because of massive energy- petroleum surpluses of the twentieth century; these surpluses plus expanding industrialization offered the illusion of advantage, of one nation’s military and ideology over the others. The appeal of these enterprises is fetishistic, pregnant with murder. At the same time, autocracies are impractical, they tend toward irrelevancy like water downhill – not because of humanity’s provident nature – but due instead to the vanishing resource surpluses needed to keep them afloat. Autocracies are expensive: we don’t have enough experience with them to understand why. Because neither liberals nor autocrats can create resources; any promise of increased access to them is false; those making the promises are promoting Ponzi schemes.

What we’re left with, a diminished menu of false promises and desperate gambles where the ‘house’ always wins. The better idea for success would be for everyone to consume less, for all of us to live within means, within the solar energy budget like all other life forms on Planet Earth. That means a rethinking of our precious toys, fashions and entertainments. Economists positively refuse to understand credit, money, ‘wealth’ are simply derivative claims against purchasing power which itself is a claim against capital: capital being non-renewable resources which are the basis of all production. As capital is cannibalized by the toys, so is purchasing power, the process is self-limiting, there is always less, at some point not enough to go around.