It’s hard to miss the Big Idea that the wheels are coming off the grand twentieth-century capitalist experiment; waste for its own sake, or waste for the sake of moving all-important ‘economic indicators’, waste for the purpose of enriching the even-more-important ‘entrepreneurs’ and ‘innovators’. The list of falling wheels would have to include China, Japan and Europe, but there are many more on a long list. It’s hard to think of a country in this world that doesn’t have major problems, the countries are interconnected by trade, treaty or finance so all are infected with each others’ problems in addition to their own: (Washington Post):

CDC says ‘nightmare bacteria’ a growing threatLena H. Sun

Federal officials warned Tuesday that “nightmare bacteria” — including the deadly superbug that struck a National Institutes of Health facility two years ago — are increasingly resistant to even the strongest antibiotics, posing a growing threat to hospitals and nursing homes nationwide.

Thomas Frieden, director of the Centers for Disease Control and Prevention, said at a news conference: “It’s not often that our scientists come to me and say we have a very serious problem and we need to sound an alarm. But that’s exactly what we are doing today.”

He called on doctors, hospital leaders and health officials to work together to stop the spread of the infections. “Our strongest antibiotics don’t work, and patients are left with potentially untreatable infections,” he said.

Just like the finance economy, the biosphere, the political economy; there are “potentially untreatable … infections”. The treatments remaining in the pharmacy are the same treatments that spawned the problems in the first place: repeat applications of MORE, everywhere in the world. If MORE cannot be had immediately there are earnest promises of MORE to come … tomorrow!

A ‘Big Idea’ that is making the rounds has the various countries engaged in a currency war. Nations actively depreciate their own currencies so that they might gain export trade advantage at the expense of others.

Instead, the nations are engaged in a war for petroleum that is being waged with currency. As in all wars there are the winners who will gain fuel imports, the losers will have limited access to petroleum, their domestic fuel consumption will be exported to the winners.

In this war all the countries are engaged, to do otherwise would be to give up claims on petroleum in the future. To have a seat at the table or have any chance of winning, the countries must waste as much- as fast as possible, as waste is the collateral for the needed (depreciated) currency. The advantage lies with the United States, not only does it waste more than the others, but it produces as a consequence much of the world’s credit. The waste of other countries such as China is collateral for American credit, that is, collateral for even more American waste.

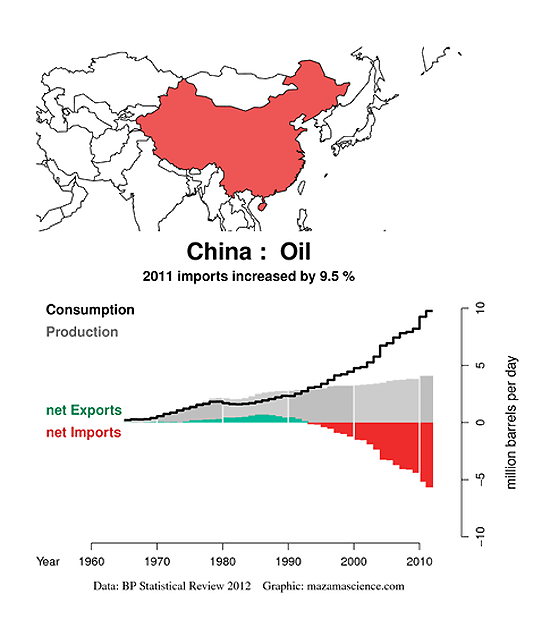

Figure 1: China crude oil imports vs. exports from Mazama Science (click on for big). So far, China is winning, it must waste or be left behind: China currency is tethered to the dollar, its fate is intertwined with ours. To run in place the Chinese must waste more than the Americans, adding to both countries’ prodigious waste- costs.

As in America, China’s waste is promoted to the citizens as ‘progress’. These ‘improvements’ never acknowledge China’s multi-thousand-year traditions or even meet any real human needs. Instead, grandiose follies are heaped upon monstrous excesses … the process serves to rationalize the excesses’ so-called ‘value’. As with the other developed countries, sunk capital has the country by the neck. China’s vast waste is collateral for China’s vast debts, to service the debts it must add to collateral. The country devours energy today so that it might devour even more tomorrow. It’s always tomorrow, good or ill, China must devour otherwise the hated Americans will do so in its place.

The bravado of the xenophobic industrialism rings hollow, to win this war over resources is to lose: permanent smog, water pollution, desertification, land theft, an out of control loan-shark economy and high level capital flight. China growth is gained by constructing buildings rather than using them: ‘growth’ is thousands upon thousands of gigantic stone heads concrete towers.

Credit-driven speculation in apartments and office towers in China is intended to be a hedge against rising energy costs, just like recent credit-speculation in tract houses in the US and Tokyo office buildings twenty years ago. The Big Idea is that building prices will rise faster than the credit-inflated fuel prices. By this way of thinking, fuel is always affordable because what sets the price — credit — is the means to meet the price — credit driven momentum-chasing in asset markets. Fuel is simply another asset, rationed by access to credit.

These kinds of hedges arbitrage stupidity, they live in the hedgers’ minds and nowhere else. On Planet Earth fuel is either plentiful or not: what sets the price of fuel is the credit-cost to pull it from the ground plus a supply-and-demand driven scarcity premium. The real cost of fuel increases relentlessly over time because of depletion, meanwhile, the internal costs of the hedges increase as well. Even when fuel costs remain low, as they were from the mid-eighties to the end of the millennium, the hedges become unprofitable and collapse.

For hedgers to gain their fuel, the asset(s) must be sold to others more effectively greedy than the hedger. Whether they sell to actual customers or take out loans against their investment doesn’t matter. The selling reduces the number of potential customers: sooner or later they run out, even in populous China! That is the end of the hedge.

The Chinese who buy these buildings are unwitting conscripts in the great global currency war over petroleum. Millions of relatively prosperous Chinese have invested the life-savings of generations in future energy waste. In a world with diminishing energy supplies, the investments are stranded. The Chinese cannot afford to make use of all the currently empty buildings and the cities that contain them, otherwise they would be doing so! The Chinese would have been much better served to invest in conservation, instead they have invested in ‘conservation by other means’.

Another reason for the Chinese building frenzy is to literally set in concrete the claims of developers and urbanites over prior occupants of China’s countryside. This Big Idea is no different from Anglo-American claims that were perfected on native lands in the 19th century with farms and mines, railroads, towns and barbed wire cattle fences. There are certainly less costly ways that are equally effective and more equitable than the Big Stone Head approach.

Keep in mind, when the Chinese property bubble unravels like all the others, the banking system will be ruined. So too if one of the major currencies such as the euro, sterling or yen fails … that is, if China wins the currency war. China holds hundreds of billions- or trillions of these currencies as reserves, its positions are far too large to unwind. A currency failure, a run out of banks or a bond market hiccup would bankrupt China finance … which in turn would bankrupt the rest of the world’s finance.

Mercantilism is another Big Idea energy hedge. A country obtains petroleum at a price and uses some of it to make high-worth goods such as (fake) Gucci handbags or Lexuses which are sold to customers overseas. The gains from the sale pay for the country’s fuel plus profits to the manufacturers.

The mercantile country and its firms borrow against the overseas trading partners’ accounts. Exporter’s fuel consumption grows larger than what it ordinarily would be without the trade. This is the presumed intent of today’s currency combatants, for each become successful mercantilists and have ‘others’ subsidize their fuel waste.

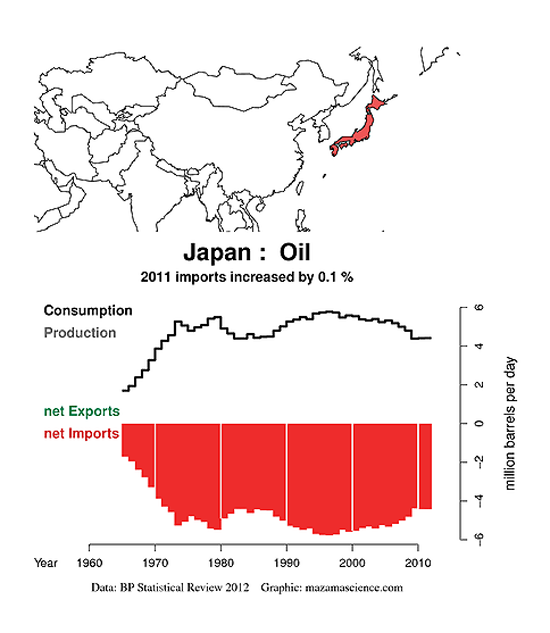

Figure 2: Japan is going broke because its fuel imports are too costly to be met by export of its goods to increasingly broke customers. The reason the customers are broke is high fuel prices! They cannot find any countries to subsidize their own fuel waste.

If Japan doesn’t depreciate its currency it cannot export or win the petroleum war. At the same time, if it depreciates any gains from exports will offset by increased fuel cost. If the yen is sufficiently beaten down the world’s fuel suppliers will not accept it and demand dollars instead.

Japan has large foreign currency reserves but these are collateral for domestic debt. Like China, Japan has few options to free up its collateral: whatever collateral it can access is over-committed.

Japan is orbiting the drain, the recent trade deficit is the last straw, the country has too many obligations to meet … all of them coming due at once. The inflow of overseas funds into Japan and the carry trade have been the means by which the country has endured deflation without the associated depression. Japan now needs more waste — growth — or a return to the inflow of overseas funds.

Depreciating the yen is a symptom of Japan’s “potentially untreatable infection” — its past success is now killing the country. Japan is beyond desperate: on deck is nominal GDP (NGDP) targeting. This is the Bank of Japan making unsecured loans (because the Japanese private sector finance is not making any).

Sadly, the Japanese establishment does not understand why the private finance does not lend … they are in denial like the rest of the industrialized world. The private sector is bankrupt, it cannot borrow! So are Japan’s overseas customers, they just aren’t announcing it. Instead, they pretend and hope nobody is paying attention.

Deflation feeds on remedies designed to defeat it. All avenues here lead to entropy: if the private sector delevers, the government itself becomes insolvent. If Japan’s central bank leverages itself, it too becomes insolvent and there is no lender of last resort. The result is a run on Japanese banks and out of yen.

Around the world, various finance markets are pressurized, the Big Idea is to wring out volatility and create a Potemkin market that can pass as the real thing; ditto commodities, particularly gold, copper, foodstuffs and petroleum.

Time marches on and costs of volatility suppression are added to other ex-market costs, volatility emerges where the suppression forces are weakest. Right now, this is the currency markets. Switzerland can peg its currency to the euro at an affordable cost, just like the Chinese can peg its currency to dollars. Today’s question is where and how does Japan fit in particularly with its new trade deficit?

Japan has its own currency, unlike Europe, its treasury can issue yen to retire debt, extinguishing the self-created currency along with the debt. However, this remedy is likely too late to apply b/c the Japanese banking system is insolvent. An issue of government notes sufficient to effect Japan’s debt market would cause the banks to collapse.

Meanwhile, the Big Idea in Europe is the purposeful absence of any ideas at all! The technocrats are disappearing leaving a vacuum, to be filled by demagogues.

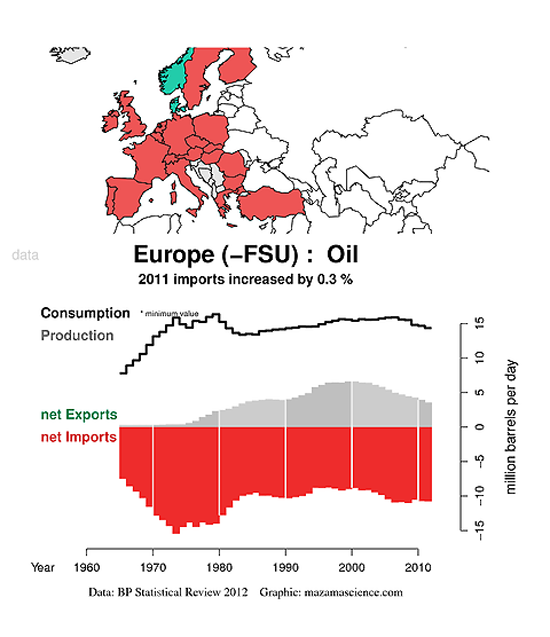

Figure 3: Europe produces about twenty-percent of its own petroleum fuel from rapidly depleting native sources, the rest must be imported. The mercantile states Germany and Italy export energy waste to others to meet their expenses, however, these customers cannot use the exporters’ waste to meet theirs. Like Japan, Europe is bankrupt.

The big difference between Europe and Japan the euro non-currency. Factionalism suggests Europe is set to lose the currency war and have its petroleum consumption shifted to others such as China and the United States. In other words, Europe cannot afford the euro, any currencies it can afford are nut suitable for the petroleum import trade. Because the euro is the currency of none of Europe’s states, there is no real issuer nor any lender of last resort, only a pretender.

Europe’s approach to the euro has been typical of the humans’ approach to everything else: to grasp what is immediately wanted then ignore life-cycle consequences. Europe wanted the euro as an energy hedge: it gave smaller countries the means to import waste from both Germany and OPEC. Now, these small countries cannot pay for the imports and the currency does not allow for the transfer of these costs to ‘others’. The waste — of course — is worthless, it cannot be ‘repossessed’.

The outcome is a Europe frozen on the spot. If it tries to pay for the expensive euro the entire continent will be ruined and unable to afford petroleum. This is the ‘austerity’ dynamic in force currently. If any country abandons the euro, the entire enterprise falls apart and there is nothing left to the Europeans with which to gain fuel. It is hardly likely that any petroleum supplier will accept a national currency from a bankrupt nation if the same nation’s bankruptcy has fatally undermined the euro! Of course, if the euro fails so will China finance, which holds massive amounts of euro-denominated debt as reserves, far too many to be readily rid of … without precipitating the disaster that it so desperately seeks to avoid.

Like so many other countries, Europe has an unraveling property bubble/energy hedge that also failed.

Meanwhile, the exit of the technocrat is the last step in post-petroleum down escalator toward chaos. After the technocrat comes zero-government, factionalism or abdication of governing authority. This is not to say that political and administrative reform is not possible; without new resources or an ‘upside down’ approach that husbands capital there is no foundation for reforms. The factions all promise MORE and a return to waste: the broken government is able to export fuel consumption elsewhere more efficiently and with less cost than do the factions, technocrats or ineffective government.

The problem in Europe and elsewhere is at the end of the everyone’s driveway. Every single day the Europeans must import twelve million barrels of crude oil at staggering cost, they must borrow from New York and London financiers to do so, as they have for ever day since the end of World War Two. Europe’s pathetic car industries cannot pay their own way much less the wasteful continent’s gigantic fuel bill. Europe is beyond insolvent, beyond broke, by rights it should never borrow again, ever, from this point in time until the sun consumes itself and balloons to fill the solar system. Europe’s bosses believe with this bit- or that bit of beautifully embellished central bank promises it can claim a good that is vanishingly rare and valuable … so that this good might be burned up for time-wasting entertainment purposes and economists’ reputations only.

This is the real Big Idea, it has not materialized in the imagination of the modern world … yet. It emerges from a concrete Big Reality that the modern human works hard to ignore. Modernity is intrinsically dysfunctional, its products are entropy and ruin. Its managers defend their right to waste as they please at the expense of the rest, the non-managers demand the right to waste along with the managers: this is madness! That a war might be waged with competitive waste as a tactic speaks to the inherent moral and physical bankruptcy of the ‘modern’ idea: it has hollowed itself out. At the end of the day the competitors are all smashed, together. There can realistically be no other outcome.

The next Big Idea must be an economy that rewards conservation and the husbandry of capital by every and all means, that treats all of capital as precious, rather than a substitutable ‘input’. It isn’t such a hard idea to grasp, its application is becoming a desperate necessity. Stewardship is less difficult than competitive depreciation financed by increased resource waste. In a well-functioning conservation economy shepherds of capital become rich and by so doing the others would become rich along with them. There is still entropy, but not the Hammer of Thor.

Time is running out … we adapt or else.