… the President lies on TV about energy:

According to the president, the country has 100 years’ supply of natural gas … everyone knows this, even the president who is a square, the last to know everything. Right?

When a president mentions energy in any speech is a big red flag. The word energy from the president always has ‘problem’ lurking somewhere in the background: remember Jimmy Carter. The president suggests our problem is a matter of perception: this must be ‘the audacity of something-or-other’ that the ‘frantic urgency of nothing in particlar’ that have become part of the national conversation as a consequence of Mr. Obama’s presidency.

Frantic urgency to waste: keep in mind at all times that every single word and phrase of the president’s State of the Union Address is scrutinized and measured by flotillas of lawyers and professionals … and algorithms. The president does not write the speech, highly paid national security specialists … and algorithms … write the speech. Every word in the speech is there for a specific purpose. The president just didn’t blurt out by accident that the country has 100 years supply of natural gas: this misstatement was calibrated … by an algorithm.

The algorithm conveniently overlooked proven reserves or the rate of consumption, whether that rate would increase or decrease. For example, if we use no gas we have hundreds of thousands of years of supply. If the US had the same proven reserves as Saudi Arabia — or a bit better — we would have 13 years at the current rates of consumption.

Wiki — and the US EIA — gives the US about 9 trillion cubic meters of proven reserves.

At the current US rate of consumption, Russia, with six-times US reserves, would give us 80 years supply. Perhaps the president’s statement signals the upcoming invasion of Russia! The only way the US would get 100 years out of Russia’s massive reserves would be with stringent conservation! It would also mean no gas at all for Europe, the Baltic states, Belarus or Ukraine … or Russia itself.

Notice the map @ the right. Surprisingly out of focus on the high-definition TV, the map is overlapped with suggestive continent-sized giant, gassy bubbles. The map itself is made up of pink blobs giving the impression that America is bulging with natural gas … that a pin pricking the ground anywhere will cause the gas to flow. There are only a few areas in the country that are gas deposit free: the Eastern Seaboard, Minnesota, Nevada and the Pacific Northwest.

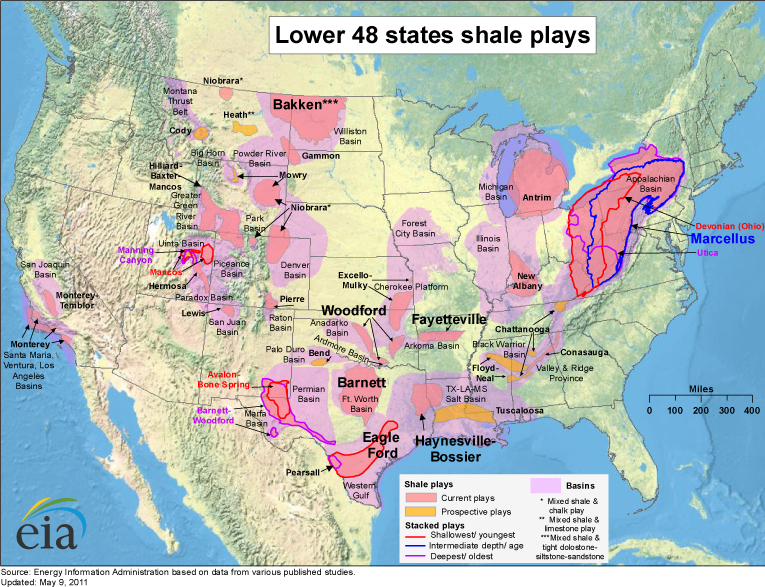

The map is published by the US Energy Information Agency:

Notice the gas- and oil bearing formations. The map is misleading because there are only a few high-output hot spots within each mauvey-pink play. Other areas are not productive or deplete very rapidly. Once production is underway, the hoped-for vast resources generally turn out to be overstated. Gas or oil that cannot be retrieved may as well not exist.

The productivity of gas or oil wells follows a curve: for every hot spot a larger number of wells must be drilled that produce an average amount then rapidly deplete. There are also large numbers of dry holes. The technology that everyone raves about doesn’t make individual wells more productive but rather cuts the number of (costly) dry holes … technology such as ‘3D seismic’ (reflection seismology).

The president never mentions cost: gaining gas from shale formations requires companies to drill far more wells than were required to extract from conventional hydrocarbon-bearing formations. He never mentions the customers ability to pay for the wells, nor does he mention the effects of drilling and hydrofracking everywhere in the country on the nation’s drinking water supply. He never mentions whether the water we have is enough … to extract the promised oil and gas.

It is the fact of the lie that is more important than the content or nature of the lie. It insists that within this government, nothing is true until it is officially denied.

You know you are in trouble when the president is not lying when he is lying.

The US actually is bubbling with natural gas, the president is right! The problem is the gas is dispersed and flows are intermittent and irretrievable. Methane gas leaks out of landfills, from marshes, from undersea clathrates, from melting permafrost, leaking around fracked wells and coal mines, it emerges from animal waste, from peat bogs … none of these are useful ‘reserves’ for the natural gas industry or its customers. Instead, the gas circles the globe in the atmosphere, contributing to climate change. Millions of cubic feet of gas are simply flared:

(TRC Solutions) Flaring natural gas from Bakken oil well. Funds are always available to lavish on waste, proper husbandry of capital and gaining the maximum return is unaffordable. Here is the perverse waste-based US energy policy made manifest: citizens and firms are given every incentive to burn through non-renewable natural resources as fast as possible. Flaring suggests that the world will come to an end if the associated oil is kept in the ground for a few more months until gas transmission infrastructure can be installed.

It also suggests there isn’t enough oil or gas to worry about, not enough to pay the bills.

You know you’re in trouble when corruption and influence peddling becomes so commonplace as to be invisible, the background noise behind ordinary business-as-usual.

Comes now another billionaire … to take his rightful place in the leadership cadre, as potential boss of the Department of Energy, (Washington Post):

Billionaire has unique role in official Washington: climate change radical

Juliet Eilperin

When Thomas Steyer — a San Francisco billionaire and major Democratic donor — discusses climate change, he feels as if one of two things is true: What he’s saying is blindingly obvious, or insane.

“I feel like the guy in the movie who goes into the diner and says, ‘There are zombies in the woods and they’re eating our children,’ ” Steyer said during a recent breakfast at the Georgetown Four Seasons, his first appointment in a day that included meetings with a senator, a White House confidant and other D.C. luminaries.

It’s a somewhat shocking statement for someone who’s in the running to succeed the cerebral Steven Chu as energy secretary. Granted, he’s a long shot — the leading contender is MIT professor Ernest Moniz, who served as the department’s undersecretary during the Clinton administration …

Unsurprising that leading nominee Moniz is a Clinton retread and nuclear industry whore. Recycled insiders from previous regimes has been a characteristic of the Obama administration … bet the rent on Moniz (Reuters).

Moniz, who was undersecretary at the Energy Department during the Clinton administration, is a familiar figure on Capitol Hill, where he has often talked to lawmakers about how abundant supplies of U.S. natural gas will gradually replace coal as a source of electricity.Moniz is director of MIT’s Energy Initiative, a research group that gets funding from industry heavyweights including BP, Chevron, and Saudi Aramco for academic work on projects aimed at reducing climate-changing greenhouse gases. (Reporting by Roberta Rampton and Jeff Mason; Editing by Paul Simao)

While Moniz is a tycoon enabler, Steyer is an actual tycoon. He offers more upside to Obama than the technocrat Moniz. With Steyer’s connections, Obama could wind up being somebody after he’s finished with his probationary period as president … Steyer might even capitalize an Obama hedge fund!

Steyer is taking on a more prominent public role. On Sunday, he spoke to a crowd that organizers estimated at 35,000, gathered on the Mall to call for a stronger national climate policy.“I’m not the first person you’d expect to be here today. I’m not a college professor and I don’t run an environmental organization,” he said. “For the last 30 years I’ve been a professional investor and I’ve been looking at billion-dollar investments for decades and I’m here to tell you one thing: The Keystone pipeline is not a good investment.”The move stems from an uncomfortable conclusion Steyer has reached: The incremental political victories he and others have been celebrating fall well short of what’s needed to avert catastrophic global warming. “If we can win every single battle and lose the war, then we’re doing something wrong,” he said, moments after consuming two mochas on the table before him.

The simultaneous mocha-drinking is understandable: Steyer had arrived just hours before on the red-eye, which he chooses over a private jet to reduce his carbon footprint. He may have built one of the nation’s most successful hedge funds — Farallon Capital Management, named after the waters off San Francisco Bay teeming with great white sharks — but he’s not flashy.

It’s good to know billionaires are ordinary folks just like you and me … while at the same time inhabitants of the rarefied precincts of sacred money. As a consequence, star-struck Eilperin avoids shining any light into the dark corners of Steyer’s fund, (Wikipedia):

Tom Steyer founded Farallon in January 1986 with $15 million in seed capital. Previously, Steyer worked for San Francisco-based private equity firm Hellman & Friedman, as a risk arbitrage trader, under Robert Rubin, at Goldman Sachs and in Morgan Stanley’s corporate mergers and acquisitions department.

Rubin … Goldman-Sachs … take it back: Steyer is certainly equally qualified- if not more so than ‘Brand X’ candidate Moniz. In Washington, DC, where money talks, Steyer carries his own lobbyist around in his wallet.

Steyer knows coal because Farallon once owned the 2d largest coal-fired power plant in Indonesia! The following is from a report criticizing Steyer’s handling of university endowment funds (Amanda Ciafone, Working Group on Globalization and Culture, Yale University):

(Un)Fa(i)rallon in the Endowment:

Tracking Yale’s Global CapitalismIn 2002, when Farallon purchased a 51% stake of Indonesia’s Bank Central Asia for $520 million dollars the fund could not avoid the high visibility of mainstream media attention. Bank Central Asia was the “crown jewel” of Indonesia’s banking sector with approximately $10 billion in assets and eight million customer accounts. In 1998, when the Asian financial crisis brought on by foreign investment and currency speculation brought Indonesia’s banks “to the brink of ruin,” the Indonesian government nationalized the bank, bailing it out and taking on its debtors by replacing unpaid loans with government bonds.

In line with demands from the IMF, the sale of Bank Central Asia was seen as crucial to the overall success of the government’s privatization program: “international lenders and the IMF placed great emphasis on BCA’s divestment as a yardstick of economic reform, threatening to withhold financial aid if it was not completed.” Private investors could now buy an Asian bank on the cheap. Although it offered 25 rupiah a share less and has never run a bank, Farallon was chosen over other bidders. In fact, Farallon had won a huge asset for Yale and its other investors; for the $520 million it paid, it bought a bank predicted to earn $650 million in government interest payments a year for the next few years. In actuality, the Indonesian government was paying Farallon interest on its own bonds originally issued to save the bank that Farallon now owns.

Ciafone questions how non-Indonesian Farallon could buy the bank with both the lower bid and zero-experience in running a financial institution? It emerged that Farallon was well connected in Indonesia and could leverage its friends in high places (IMF) better than the other financiers.

Some of Farallon’s (Yale’s) money was invested in Paiton I, Indonesia’s first private power venture and “one of the most expensive power deals of the decade.” As the first private power project in the country the huge Paiton I coal burning power plant set the tone for subsequent private power ventures which “cut overpriced, politically influenced deals that undermined the Indonesian economy.” Although little is known about Farallon’s connection to the Paiton project, the financial press revealed that Farallon held a “controlling position in the $180 million [bond] issue” of Indonesia’s Paiton I plant. But much is known about the nature of the Paiton I project; three Wall Street Journal investigative articles detail the crony capitalism, price gauging, and environmental risks surrounding the plant in Indonesia.

It’s hard to say who would be worse as DOE Boss: captive insider Moniz or finance criminal Steyer. Both are creatures of the money-establishment: the end result is more of the current status-quo: lies and continuing incentives to waste, more theft from the citizens by tycoons. Regardless who whomever becomes DOE Boss, don’t expect any real change as to do so might adversely effect tycoons’ two-fisted lifestyles.

Meanwhile, you know you are in trouble when the Federal Reserve is lending $85 billion dollars to the Federal Government and the mortgage business every month.

It is both worrisome and suggestive that the central bank is such a large lender to the government. Are there no other lenders? This is a tremendous red flag: this sort of direct monetization suggests the government is a credit risk.

Is is also worrisome and suggestive when the Fed is lending billions every day to the mortgage industry. If the industry was solvent it would not need a continuing $40 billion-per-month bailout! At the same time, it is worrisome that the Fed is guaranteeing bank deposits. When the Fed accepts securities as collateral during open market operations such as ongoing Quantitative Easing (QE) it credits the banks with ‘excess’ reserves. These reserves are never deployed (into circulation) unless the banks’ balance sheets are collapsing … as when there are runs on the banks.

Does the Fed know something about the banks we should worry about?

You know you are in trouble when the inflation/deflation argument is still with us.

Deflation tends to be described as a change in prices for goods, a fall in the general price level or a contraction of credit and available money. Rather, deflation is where the cost of repayment of any debt is greater in real terms than the worth of the debt.

Current deflation is meaningless out of context of debt and energy. The world is running out of energy and has taken on $640 trillion$ in debt in order to run out of energy.

There is debt deflation when the cost of repaying a debt increases as the debt is repaid, because the act of repayment extinguishes currency. The scarcity premium of currency increases faster than the rate at which the debt(s) can be retired. In fact, debt repayments by 3d parties has the effect of rendering all debts unaffordably costly to repay. Read Irving Fisher’s paper on ‘Debt Deflation’ (1933).

Energy deflation occurs when energy becomes scarce and more expensive in real terms, there is a scarcity premium added to fuel that the customers cannot afford … fuel becomes too valuable to waste by driving tens of millions of useless cars in circles from gas station(s) to gas station(s).

Fuel is hoarded or unaffordable, so is money used to buy fuel. If currency is more useful to gain fuel than credit, there is no credit. The cycle is broken only when there is no fuel or no demand for it.

Economists are blind to the distinction between ledger loans (amounts noted on spreadsheets as due and payable) and circulating money.

Central banks offer ledger loans as do private sector lenders. The latter offer unsecured loans to customers. Ledger loans are credits made to borrowers’ accounts, funds thereto are simply ‘invented’. As the name implies, circulating money is loans that have changed hands to 3d (or more) parties in the marketplace where their worth is determined.

Banks’ offering unsecured loans is called ‘inflation’, demanding circulating money as repayment for unsecured loans is called ‘deflation’. Since most repayment is made by taking out greater loans, inflation tends to be a background condition. Unsecured loans represent economic ‘growth’ as their tally makes up the components of GDP.

Private sector lenders demand repayment in circulating money which is always in limited/finite supply. Borrowers cannot offer ledger repayments! They must earn, borrow or steal the funds demanded for repayment from others who then do not have the funds. Repayment reduces the amount of money in circulation which reduces GDP. When repayment demands exceed the amount of new loans there is a recession.

Clearly, offering more ledger credit — which costs very little — and gaining circulating money in return — which costs everything — is good business for lenders. Everyone is robbed whether they borrow or not because of the increased scarcity and cost of needed circulating money!

Central banks cannot make unsecured loans (loans in excess of collateral) therefor there is no such thing as central bank ‘money printing’. Because reserve banks have no capital structure — they are reserve banks after all — they cannot extend unsecured credit. Any central bank that offers unsecured loans is instantly and permanently insolvent!

This is not an Economic Undertow supposition but a condition like gravity. If ordinary commercial or depository banks are rendered insolvent by excess leverage and bad loans, a central bank which leverages itself while taking on the bad loans of its clients is ruined just the same as the other banks, for the same reason!

Under such circumstances, there is no effective lender of last resort, the only real collateral for all loans is currency on deposit. There are bank runs to redeem as much as possible … (as are underway in Europe and commencing in Japan).

The outcome of the discussion is delay in implementing reforms. Meanwhile, there is ongoing energy- and resource waste.

You know you are in trouble when your world burns 88.8 million barrels of petroleum per day … and is fantastically in debt by trillions of dollars!

That petroleum is gone forever. Another 88.8 million barrels will flush down the toilet tomorrow and another 88.8 million the day after … day after day after day!

and the day after that. What do we get in return for 88.8 million barrels per day? People laugh at the Medievals but they left behind some nice towns and useful buildings. What do we have to show … for the million barrels … burned up for nothing every single day for decades?

We have some used cars, some potholed ‘infrastructure’, millions of ugly buildings … we’re bankrupt.

In order to burn the 88.8 million barrels we’ve had to borrow billions of dollars from bankers and finance every day, as well, The total amount we owe to the financiers is $640 TRILLION dollars (Bank for International Settlements, PDF warning)!

Don’t listen to the soothing bromides of the analysts. Each swap noted on BIS ledgers cost someone real money, they hedge something real, the total system credit including that derived by way of foreign exchange.

We burn instead of holding onto our oil until someone can figure out something better to do with it. We rush to burn as much as possible as fast as possible. We want to burn it faster so that we can change some ‘indicators’ and allow tycoons, ‘entrepreneurs’ and ‘innovators’ to borrow some more.

We are like a family that has inherited a palace: we have burned all the furniture in order to keep warm now the furniture is gone we must burn the house. Well-dressed salesmen knock on the door offering efficient saws and furnaces to cut the house apart and burn it.

Madness … whatever is happening to us we deserve it.