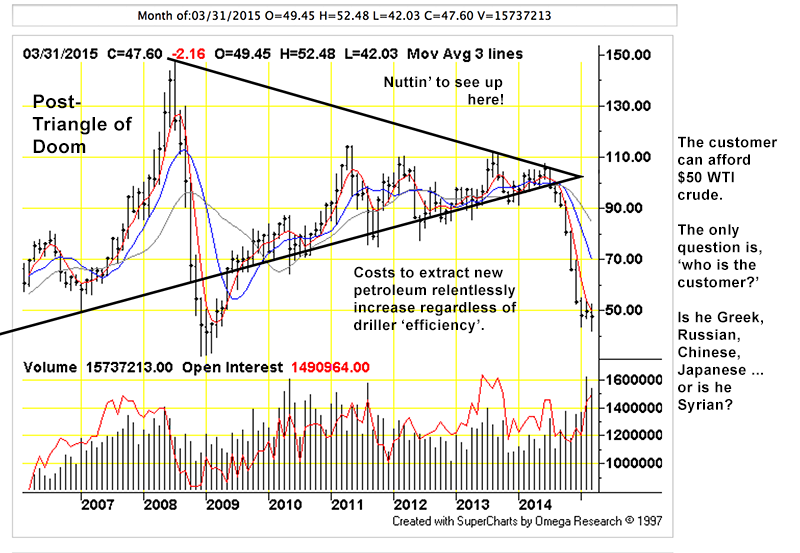

Figure 1: We have now entered the post-economic Triangle of Doom period TFC Charts, (click on for big); the triangle has outlived its usefulness, the oil – credit markets have broken down. What remains is relentless decline … as resources along with purchasing power are annihilated.

Can we handle it? In place of hard-headed realism and a turn toward effective policy, there is denial and lies. Analysts insist lower oil prices have no affect on output. Others pretend that debt-riddled economies can be cured by adding more debt. In ways great and small, the real world offers clear warnings about consequences of consumption … but these are ignored as the establishment frolics on Fantasy Island.

From the dawn of the industrial era, companies have been able to stay afloat by borrowing. This included oil drillers: since 2008, extraction firms have borrowed over a trillion dollars at very low cost. They can certainly and reasonably expect to borrow more, after all the funds cost the lenders nothing to create. But who repays? Someone must: a firm can borrow from its own lenders for a long time but at some point the customers must step up and borrow for the firm’s benefit. Otherwise the firm’s indebtedness becomes greater than any potential number of customers can bear: at that point the firm is insolvent and out of business.

The ongoing petroleum price crash is by itself evidence that customers can no longer support the oil industry. Citizens cannot lend their own funds into existence, they must borrow from others or swap their time- and skills for (borrowed) funds. Because the aggregate worth of human labor represents a kind of upper bound to leverage, the outcome is a ‘repayment shortage’ which strands the drillers and their lenders; every additional dollar a firm borrows to stay alive is a dollar that is ultimately uncollectible from the firm’s tapped-out customers.

Stripped to fundamentals, oil use turns out to be recreational not economic. Modernity is revealed to be nothing more than ‘lifestyle’, pointless wars and other distractions. We must eat and drink to live, we drive to fill the empty spaces between television shows.

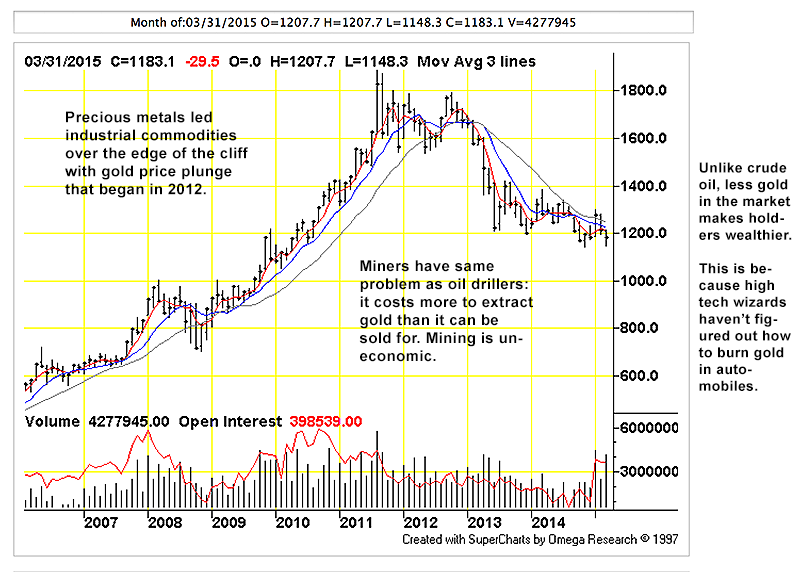

Figure 2: The gold futures continuous contract by way of TFC Charts, (click for big): gold has led the industrial commodity markets down, with its own break occurring in 2012. The gold price trend over the past year and a half is generally sideways. Look for similar price action in other commodities including petroleum over the intermediate term.

Gold can be sold below cost because it is indestructible whereas oil is simply wasted. Any shortage of new gold results in a scarcity premium being attached to the gold that remains above ground. The premium is real, not necessarily nominal, the beneficiaries are the gold holders who gain whether new gold is mined or not.

Selling below cost does not work with petroleum because consumers destroy it, what they gain in return is generally worthless. In this way, fuel users turn their asset into a compounding liability. Unlike gold, the petroleum scarcity premium doesn’t benefit anyone either holders (drillers or distributors) or customers, scarcity takes the form of a disruptive tax … that is ultimately uncollectible from the firms’ tapped-out customers.

Denial creates its own perverse dynamic: when low prices do not provoke the needed ‘lifestyle adjustments’ they decline further until they do. Conservation is the necessary adjustment, yet low prices are an incentive to waste more. When customers conserve there is the appearance of a ‘glut’, this in turn leads to lower prices. The outcome is a price signal that is hard to interpret, confusion rather than clarity because the consumer response to the ‘false glut’ and a real one is the same.

Real price increases can only occur when customers become wealthier relative to the drillers … when they become able- willing to borrow more; when repayment obligations can be shifted onto others. None of this is happening right now, instead customers are bankrupted by their own energy waste. Because fuel use does not produce anything; industries can only offer improved efficiency, that is, the exhaustion of what remains of our non-renewable capital at a slightly slower pace. The same efficiency means losses that must be made up with volume => diminished (non-existent) collateral for loans => less ‘growth’ and lower prices including interest cost of money. Increased efficiency means more unsecured lending, more finance industry risk along with diminished ability to properly price it; along with customer bankruptcy, these are forms the petroleum scarcity premium assumes.

A long-term resident on Fantasy Island is Ambrose Evans-Pritchard:

Oil slump may deepen as US shale fights Opec to a standstillContinental’s Harold Hamm says US shale industry has ‘only begun to scratch the surface’ of vast and cheap reserves, driving growth for years to come.

The US shale industry has failed to crack as expected. North Sea oil drillers and high-cost producers off the coast of Africa are in dire straits, but America’s “flexi-frackers” remain largely unruffled.

One starts to glimpse the extraordinary possibility that the US oil industry could be the last one standing in a long and bitter price war for global market share, or may at least emerge as an energy superpower with greater political staying-power than Opec.

It is 10 months since the global crude market buckled, turning into a full-blown rout in November when Saudi Arabia abandoned its role as the oil world’s “Federal Reserve” and opted instead to drive out competitors.

If the purpose was to choke the US “tight oil” industry before it becomes an existential threat – and to choke solar power in the process – it risks going badly awry, though perhaps they had no choice. “There was a strong expectation that the US system would crash. It hasn’t,” said Atul Arya, from IHS.

“The freight train of North American tight oil has just kept on coming. This is a classic price discovery exercise,” said Rex Tillerson, head of Exxon Mobil, the big brother of the Western oil industry.

Mr Tillerson said shale producers are more agile than critics expected, which means that the price war will go on. “This is going to last for a while,” he said, warning that any rallies are likely to prove false dawns.

Enter the Petro-industry Ponzi buzz-words: ‘vast and cheap’, ‘flexi-frackers’, ‘energy superpower’ and ‘price discovery exercise’: what is wrong with these? A: just about everything …

Hamm and Exxon have both lost billions since the beginning of the year. It isn’t just private companies: Russia, Saudia, Brazil even Islamic State have lost ‘vast’ amounts of income from fuel sales. It is nonsense to believe that these losses are inconsequential. Someone must bear them, if not the firms then the firms’ lenders and loan guarantors; if not the governments then certainly the drilling agencies which require investment funds. Every one, company and country, is dependent upon the borrowing capacity of their customers …

A large percentage of mid-sized energy firms are simply failing. So are lenders who stand to be wiped out, also Canada and its poorly conceived real estate extravaganza … also Canada banks. Don’t forget Australia; also Russia. Previously drilled wells are left uncompleted, rig count has plunged. The assumption is that shortages will re-ignite a bidding contest; however, customer purchasing power shrinks faster than the rate of depletion. This is because the elites’ share of purchasing power expands at the expense of the customers’. As a consequence, even very low prices for petroleum and other resources are unaffordable at any given time.

Fantasy Islander Jeffrey Sachs suggests American fuel- guzzling, Las Vegas lifestyles can be powered with solar panels and windmills. Sachs ignores how wimpy/pathetic these power sources are compared to gigaton carbon burning and nuclear, (Project Syndicate):

Jeffrey D. Sachs, Professor of Sustainable Development, Professor of Health Policy and Management, and Director of the Earth Institute at Columbia University, is also Special Adviser to the United Nations Secretary-General on the Millennium Development Goals.

ExxonMobil’s Dangerous Business Strategy

Jeffery Sachs

NEW YORK – ExxonMobil’s current business strategy is a danger to its shareholders and the world. We were reminded of this once again in a report of the National Petroleum Council’s Arctic Committee, chaired by ExxonMobil CEO Rex Tillerson. The report calls on the US government to proceed with Arctic drilling for oil and gas – without mentioning the consequences for climate change.

While other oil companies are starting to speak straightforwardly about climate change, ExxonMobil’s business model continues to deny reality. That approach is not only morally wrong; it is also doomed financially.

The year 2014 was the hottest on instrument record, a grim reminder of the planetary stakes of this year’s global climate negotiations, which will culminate in Paris in December. The world’s governments have agreed to keep human-induced warming to below 2º Celsius (3.6º Fahrenheit). Yet the current trajectory implies warming far beyond this limit, possibly 4-6º Celsius by the end of this century.

Just as the global shift toward renewable energy has already contributed to a massive drop in oil prices, climate policies that will be adopted in future years will render new Arctic drilling a huge waste of resources.

Sachs is as hopeful as Evans-Pritchard, he fusses over extraction but simply dismisses the consumption side with a breezy, hand-waving reference to: “low-carbon energy like wind and solar power, and to electric vehicles powered by low-carbon electricity.”

Low-carbon wind and solar are high cost, dispersed power sources that cannot provide the same loss-leading subsidy to industry that petroleum has offered since the turn of the 20th century. Sachs assumes that the same consumers who are too broke to afford diesel and gasoline will somehow pony up for alternatives that have greater life-cycle costs … alternatives that are themselves entirely dependent upon unaffordable diesel and gasoline for manufacture, transport, installation and maintenance.

Wind and solar might become something more than a marginal amendment to conventional grid electric or portable generators but this is hard to quantify due to intermittancy. EROI calculations tend to omit storage- and grid/infrastructure costs. Also avoided is energy cost of the factories making the turbine- and panel factories, factory components and these factories’ components in turn. Transportation and installation costs are difficult to calculate because they are not monolithic, self-contained processes but widely distributed (most panels are made in China and installed elsewhere). The manufacturing base of transportation industry is itself fossil fuel dependent.

Widespread penetration of low-carbon electric vehicles is found on Fantasy Island and nowhere else: every kind of car is possessed of immense life-cycle costs including interconnected chains of energy gobbling factories and infrastructure. There are no solar tires or window glass, no wind-turbine highways, bridges or real estate developments. Infrastructure requires steel, concrete, plastic and asphalt; all of these require work, high-density power derived from fossil fuels.

Our planetary scale built environment is likewise dependent upon ‘vast’ and ‘massive’ finance industry debt … as are solar panels and wind turbines.

Most likely, that ” … global shift toward renewable energy,” has added to fossil fuel demand where it would otherwise decline. Only indirectly has renewable energy triggered Prof. Sachs’ “massive drop in oil prices …” Solar and wind firms must borrow, in doing so they strip credit from their hapless customers … collapsing oil prices by way of the back door.

Energy Commodity Futures (Bloomberg)

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| Crude Oil (WTI) | USD/bbl. | 55.74 | -0.97 | -1.71% | May 15 |

| Crude Oil (Brent) | USD/bbl. | 63.45 | -0.53 | -0.83% | Jun 15 |

| RBOB Gasoline | USd/gal. | 192.99 | -0.55 | -0.28% | May 15 |

| NYMEX Natural Gas | USD/MMBtu | 2.63 | -0.05 | -1.86% | May 15 |

| NYMEX Heating Oil | USd/gal. | 188.24 | -2.56 | -1.34% | May 15 |

Precious and Industrial Metals

| Commodity | Units | Price | Change | % Change | Contract |

|---|---|---|---|---|---|

| COMEX Gold | USD/t oz. | 1,203.10 | +5.10 | +0.43% | Jun 15 |

| Gold Spot | USD/t oz. | 1,204.22 | +5.67 | +0.47% | N/A |

| COMEX Silver | USD/t oz. | 16.23 | -0.06 | -0.34% | May 15 |

| COMEX Copper | USd/lb. | 277.00 | +0.25 | +0.09% | Jul 15 |

| Platinum Spot | USD/t oz. | 1,171.50 | +11.75 | +1.01% | N/A |

Next to Sachs and Evans-Pritchard on Fantasy Island are the Greeks and their European bankers, (Wolf Richter):

The Greek People Just Destroyed Syriza’s StrategyGreek stocks ventured deeper into purgatory. The ASE index dove below 700 intraday on Wednesday for the first time since the crisis days of June 2012. Then word spread that the ECB had raised the cap on the Emergency Liquidity Assistance for Greek banks by €1.5 billion to €75.5 billion. It’s the oxygen line for Greek banks. Without it, they’re toast.

The ELA provides the liquidity so that the Greeks can continue yanking their beloved euros out of their banks to stash them elsewhere before their desperate government confiscates them.

The government, under the cool leadership of Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis, is already confiscating €2.5 billion in “idle” cash that state agencies, state-owned enterprises, and local governments kept at commercial banks, the same banks that the ELA is propping up and that the Greeks are fleeing. Now these entities have to transfer the money to the central bank so that the government can “borrow” it for other purposes.

Did you get it? The flow of funds into and out of Greece is almost farcical. Money loaned by the ECB originates in EU banks, the ECB is a conduit. The funds flow to ordinary Greeks who remove them from Greek banks and re-deposit them in the same EU banks the loans came from; full circle! The EU banks are not deploying Greek savings but are instead offering loans to Greek depositors who are themselves are on the hook for repayment … the Greeks are in essence getting loans instead of their own money … the costs of which the depositors are attempting to dodge by hustling their funds out of Greece … Meanwhile, repayment for loans to Greek depositors are being extracted from the same Greek depositors by the Greek government!

You cannot make this s**t up. Behind the Vaudeville is the fantasy of Greece leaving (being forced out of) the euro. This is impossible, it cannot happen and everyone knows it. The only outcome is the euro lives or the euro dies.

The euro = gasoline. The Europeans including Greeks will never voluntarily give the euro up because it enables driving. Without the euro half of the Europeans would have to walk … horrors! Even if the Greeks could somehow ‘go off’ the euro, it would still circulate in Greece but outside the reach of government. Greece outside the euro would create more instability than it does now. Greeks would use the euros (gasoline) and do whatever they could to get them including discount their own ‘replacement’ currency. Jettisoning the euro would not solve euro-related debt problems, either. The problems — petroleum scarcity premium — would simply be shifted around from one country to others wreaking havoc.

Greece could dollarize but the country’s credit problems would not go away. Not because the government overspends or because the Greeks have too many overpaid workers (who sadly happen to be temporarily indisposed) but because Greeks have too many cars and cannot earn anything by driving them. Greece — like the rest of the world — is bankrupted by its own fuel waste and the uncollectible petroleum scarcity premium.

Greece is an agrarian vacation paradise with smuggling rings. It has its own currency — the euro — but acts like the currency is a gift from (banking) gods. Because Greece has its own currency it really controls its own destiny to the degree that it can buy some time and use it to wean itself from imported fuel and Northern European finance credit.

Another Fantasy Island resident is Yanis Varoufakis:

A New Deal for Greece – a Project Syndicate Op-EdATHENS – Three months of negotiations between the Greek government and our European and international partners have brought about much convergence on the steps needed to overcome years of economic crisis and to bring about sustained recovery in Greece …

The “troika” institutions (the European Commission, the European Central Bank, and the International Monetary Fund) have, over the years, relied on a process of backward induction: They set a date (say, the year 2020) and a target for the ratio of nominal debt to national income (say, 120%) that must be achieved before money markets are deemed ready to lend to Greece at reasonable rates. Then, under arbitrary assumptions regarding growth rates, inflation, privatization receipts, and so forth, they compute what primary surpluses are necessary in every year, working backward to the present.

Our government’s position is that backward induction should be ditched. Instead, we should map out a forward-looking plan based on reasonable assumptions about the primary surpluses consistent with the rates of output growth, net investment, and export expansion that can stabilize Greece’s economy and debt ratio. If this means that the debt-to-GDP ratio will be higher than 120% in 2020, we devise smart ways to rationalize, re-profile, or restructure the debt – keeping in mind the aim of maximizing the effective present value that will be returned to Greece’s creditors.

Besides convincing the troika that our debt sustainability analysis should avoid the austerity trap, we must overcome the second hurdle: the “reform trap.” The previous reform program, which our partners are so adamant should not be “rolled back” by our government, was founded on internal devaluation, wage and pension cuts, loss of labor protections, and price-maximizing privatization of public assets.

Our partners believe that, given time, this agenda will work. If wages fall further, employment will rise. The way to cure an ailing pension system is to cut pensions. And privatizations should aim at higher sale prices to pay off debt that many (privately) agree is unsustainable.

By contrast, our government believes that this program has failed, leaving the population weary of reform. The best evidence of this failure is that, despite a huge drop in wages and costs, export growth has been flat (the elimination of the current-account deficit being due exclusively to the collapse of imports).

More buzzwords: ‘forward-looking’, ‘reasonable’, ‘surpluses’ (who doesn’t like surpluses?), ‘sustainability’: reassuring and even-tempered like the mad computer Hal 9000 in Kubrick’s ‘Space Odyssey’.

It’s pretty sad to see the genial/obnoxious Varoufakis scuffling from pillar to post, tugging his forelock like a latter-day Oliver Twist, begging criminals like Wolfgang Schäuble and Christine Lagarde for ‘more’; “Please sir, some more” … more loans of course. Without loans-constant increase in credit there is no Greek ‘industry’ … or any other countries’ industry for that matter.

Using econo-speak, Varoufakis attempts to square the circle, arguing the Greek claims to live large: “The others do it,” thunders/pleads Varoufakis, “why not us?” Solving an excess debt problem with more loans works on Fantasy Island but offers no hope elsewhere. Varoufakis cannot grasp the post-petroleum world he now inhabits, the world bankrupted by non-remunerative, resource-depleting ‘lifestyles’. Europe burns through 12 million barrels of imported crude oil per DAY, every barrel paid for with borrowed euros (BP). As a consequence the Continent is entirely-hopelessly insolvent; monetary flexibility is a myth, there is no such thing as independent policy; the price of the euro is set at the gas pump by millions of motorists buying (or not buying) fuel. The monetary- and fiscal establishment in Brussels and elsewhere are irrelevant. At the same time, Europeans have enslaved themselves to the (non)establishment status quo because the euro = gasoline.

The first thing the humans must do is face reality. What is underway in Greece and elsewhere is ‘Conservation by Other Means™’. There is no chance at the ‘good old days’ of wasteful consumption and auto-centric ‘development’. It’s over, its untenability IS the crisis … this should be clear to both the Greek government, the IMF, the ECB and the monetary establishment. The second order of business is for the Greek government — not finance or the central bank — to begin to issue euro payments to banks as well as individuals/firms in Greece who do business with the government. If Greek government can issue collateral by fiat it can issue payments the same way. By doing so the Greeks can end the imposed, artificial ‘money shortage’ that is strangling them and buy some precious time.

Greeks can then use the time gained to reconfigure their economy around conservation and husbandry, for the Greeks to begin to live within their means … they have no choice, one way or the other this is something that Greeks and others will do.

Cannibalizing the world’s capital/resource endowment for fun is at the heart of the ongoing crisis in Europe and elsewhere. The human technology experiment including its myriad mechanical toys is coming hard up against the limits set by thermodynamics. Physical forces do not negotiate, conditions are set and humans adapt … or else. The inevitable outcome should the Greeks stubbornly carry on is that the country becomes a kind of hybrid mafia gangland dependent upon smuggling and murder.

Nobody will admit that Europe is undone by peak oil, nobody will even discuss it or entertain the possibility! This isn’t economists in 2004 missing a prediction about what might happen in 2008. This is an entire army of exceptionally well-paid, over-educated analysts, policy makers, business leaders, economists, university professors, pundits, finance- and energy bloggers, fiction writers, poets and bass fishermen not seeing what is taking place right under their noses!

Welcome to Fantasy Island …